Today’s blog on employer/employee rules in NYC comes after spending 6 business days at CPA seminars updating tax changes and learning recent events that affect my clients.

NYC has been making more employer/employee rules and regulations.

Not only should EVERY employer have a time clock, the new employer/employee rules make it a crime for an employer to not have a time clock because it is a general disregard for the requirement to keep employee records. In one case, a restaurant was indeed considered criminal for no time cards.

More importantly, the NYS Dept. of Labor, an agency for a long time considering all employers guilty and all employees innocent turn against any employer with inadequate records.

An employee fired for just reasons, for example stealing, can still sue a prior employer for not paying over time, or not paying all wages as required, and without time cards, the employer will lose the suit. Regardless of the any outcome, the burden of proof from employee claims always falls on the employer. Beware.

As a clarification, any employee who works 10 hours in any 1 day is to be paid for 11 hours. [yes this is a real rule]

However, the additional hour of pay is not required to be at the employee pay rate, it is required at minimum wage only. So a $17/hour employee working 10 hours need only be paid $9 per hour for the non-worked 11th hour. This is contrary to what many employers believed, that the extra hour was at the employee’s rate of pay.

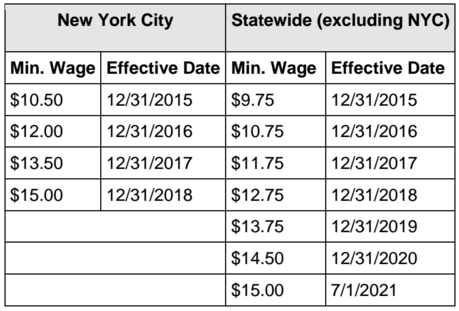

NYC wages for restaurant waiters and busboys [tipped employees] is increasing from $5 per hour to $7.50 per hour. I can’t remember the last time anyone got a 50% increase in wages. And, most importantly, the restaurant wage increase takes place 12/31 to include new year’s eve in the new rates.

Lastly, NYC requires 5 days personal/sick/vacation time to all employees. The regulations made this effective April 2014. Any employee who works 80 hours in a year starts to accrue time off. 1 hour for every 30 hours worked.

Harlan Kahn CPA

Business owners: Download our free report “Do you own your own business or does it own YOU!” to get your business moving in the right direction.